|

Newsletter Summary

Last five newsletters

Last five graphs

Note: All graphs issued with e-malt.com newsletters

are published in "Graph" section

of e-malt.com site.

Last five tables

All e-malt.com tables are published in e-malt.com Statistics section. The Statistics section includes Barley statistics, Malt statistics and Beer statistics. The tables related to barley are published in Barley Statistics section, the tables related to malt in Malt Statistics section and the tables related to beer in Beer Statistics section.

Last five prices evolutions

Last five scientific digests

Access to E-malt.com

Use the above form to have a full immediate access to E-malt.com site!

Through the drop-down menu you can easily remind your username and password,

change your username and password or even edit your account!

Do you know

E-malt.com?

Dear E-malt Reader!

E-malt.com Newsletters Archive could be found directly on

e-malt.com site.

Browsing through our Newsletters Archive you may see all the issues you have missed.

To this purpose you just have to login e-malt.com and click on Newsletters link in the menu.

Reading our Newsletters you will be kept informed with the latest news and events regarding malting and beer world.

You may also submit your own news, events or other information to the address

info@e-malt.com!

Updated figures related to USA barley and malt trade with Mexico and Canada

could be seen in NAFTA section of e-malt.com menu.

To this purpose please enter e-malt.com!

You may find updated malt, barley and beer statistics on e-malt.com

Statistics section.

Just enter e-malt.com!

Here you will find all tables issued with e-malt.com newsletters.

E-malt.com Agenda gives the possibility to keep you informed about the Events

planned to be held in the whole world related to the brewing and malting

industries. To this purpose you just have to login

e-malt.com

and click on Agenda link in the menu. Reading our Event Agenda you will find

out about the future symposia, conferences and festivals related to malting and

beer world. You may also submit your own events to the address

info@e-malt.com

E-malt.com has Trading Online system. The system is to be used for

malt/barley trading. One can register a malt/barley offer or a malt/barley

request. The registering person could be as a seller/buyer or as an agent for

seller/buyer. The User can see information about all active malt/barley offers

& requests. If needed the system allows user to buy/sell malt/barley due to

reasonable offers/requests. The way to do this is to confirm reasonable

transaction. Trading Online rules are available through the Internet in the

Trading Online as well as Tutorial (useful for persons who starts the system

usage). To visit the E-malt Trading Online first go to the E-malt.com site,

then click Trading Online link in the left menu of the e-malt.com home page.

For more details please contact info@e-malt.com

Thank You!

E-malt.com Links!

Note

If you have any comments, questions, suggestions or remarks, you can send a

mail to: info@e-malt.com.

To submit your own news to our editorial team, email to:

info@e-malt.com

If you have received this newsletter from a colleague, you can obtain your own

subscription here!

You are not registered yet? You may register

here.

You may recommend our site to your friend

by clicking here.

If you do not wish to receive our newsletter, please unsubscribe your

e-mail address from our mailing list by sending us an e-mail

info@e-malt.com.

Please take into consideration your registration data.

|

Click here to get full size Newsletter

“There is nothing for a case of nerves like a case of beer.”

Joan Goldstein

Base Currency: Euro, EUR

on 07-October-2009

1 EUR = 1.471 USD

1 EUR = 0.9228 GBP

1 EUR = 1.5669 CAD

1 EUR = 1.662 AUD

1 EUR = 131.04 JPY

1 EUR = 2.586 BRL

1 EUR = 43.8867 RUB

1 EUR = 10.0564 CNY

| Base Currency: US Dollar

on 07-October-2009

1 USD = 0.6799 EUR

1 USD = 0.6273 GBP

1 USD = 1.0652 CAD

1 USD = 1.1297 AUD

1 USD = 89.0782 JPY

1 USD = 1.758 BRL

1 USD = 29.8346 RUB

1 USD = 6.8364 CNY

|  |

Note:

Just click on the price link and you will be led to our Market

Price History. Average barley market prices are French and are

estimated on FOB Creil basis.

Average Malt Prices are theoretical and based FOB Antwerp being

estimated on French malting barley.

The changes are compared to last Newsletter's

prices. Arrows indicate the direction of the change.

EU: CVC reinforces its bid for AB InBev’s brewing assets

...Click here

EU: CVC reinforces its bid for AB InBev’s brewing assets

...Click here

|

Mexico & United Kingdom: SABMiller seen as the most likely buyer of FEMSA’s beer unit

...Click here

Mexico & United Kingdom: SABMiller seen as the most likely buyer of FEMSA’s beer unit

...Click here

|

Russia: Carlsberg should be able to take market share even if the beer tax is increased – Carlsberg CEO

...Click here

Russia: Carlsberg should be able to take market share even if the beer tax is increased – Carlsberg CEO

...Click here

|

Russia & Ukraine: The shape of beer and malt industries leaves much to be desired

...Click here

Russia & Ukraine: The shape of beer and malt industries leaves much to be desired

...Click here

|

United Kingdom: UK Office of Fair Trade reviewing Tennents’ lager deal, C&C says the transaction cannot be reversed

...Click here

United Kingdom: UK Office of Fair Trade reviewing Tennents’ lager deal, C&C says the transaction cannot be reversed

...Click here

|

World: SABMiller to achieve significant earnings growth and increase volumes thanks to emerging markets - analysts

...Click here

World: SABMiller to achieve significant earnings growth and increase volumes thanks to emerging markets - analysts

...Click here

|

Australia & United States: Australian GrainCorp to acquire the world’s fourth-largest maltster

...Click here

Australia & United States: Australian GrainCorp to acquire the world’s fourth-largest maltster

...Click here

|

World: Barley crop 2009 comes out very large despite all obstacles

...Click here

World: Barley crop 2009 comes out very large despite all obstacles

...Click here

|

EU: Barley prices below intervention level, export almost non-existent

...Click here

EU: Barley prices below intervention level, export almost non-existent

...Click here

|

China: China was the largest importer of malting barley in Jan/Aug this year

...Click here

China: China was the largest importer of malting barley in Jan/Aug this year

...Click here

|

Mexico: Grupo Modelo advised to consider its ‘strategic options’

...More Info

Mexico: Grupo Modelo advised to consider its ‘strategic options’

...More Info

|

Russia: Heineken to close one more brewery in Russia

...More Info

Russia: Heineken to close one more brewery in Russia

...More Info

|

United Kingdom: Cask ale is the only beer category that increased sales in H1 2009 - report

...More Info

United Kingdom: Cask ale is the only beer category that increased sales in H1 2009 - report

...More Info

|

United States: Part of Washington state hop crop left on the vine

...More Info

United States: Part of Washington state hop crop left on the vine

...More Info

|

Cambodia: Kingdom Breweries Ltd hoping to begin production at its new beer plant sometime in the middle of 2010

...More Info

Cambodia: Kingdom Breweries Ltd hoping to begin production at its new beer plant sometime in the middle of 2010

...More Info

|

Germany: Oktoberfest 2009: fewer visitors drink more beer than last year

...More Info

Germany: Oktoberfest 2009: fewer visitors drink more beer than last year

...More Info

|

Singapore: Asia Pacific Breweries issues first series of S$100 million notes

...More Info

Singapore: Asia Pacific Breweries issues first series of S$100 million notes

...More Info

|

Canada: Molson Coors launches Canada’s lowest calorie beer

...More Info

Canada: Molson Coors launches Canada’s lowest calorie beer

...More Info

|

Bulgaria: No plans to introduce excises on beer so far – minister of finance

...More Info

Bulgaria: No plans to introduce excises on beer so far – minister of finance

...More Info

|

Peru: SABMiller’s subsidiary launches new premium beer

...More Info

Peru: SABMiller’s subsidiary launches new premium beer

...More Info

|

EU: CVC reinforces its bid for AB InBev’s brewing assets

EU: CVC reinforces its bid for AB InBev’s brewing assets

|

Private equity firm CVC Capital Partners has put more equity into its bid for Anheuser-Busch InBev's central and eastern European (CEE) assets, two bankers close to the deal were quoted as saying by Reuters on October, 2.

According to the bankers, CVC has lifted its equity contribution to 60-65 percent of the anticipated 1.4 billion euro purchase price to clinch the sale, which is expected in the next two weeks.

"The price has gone up through the process to make the deal happen. CVC has put in more equity and the debt financing remains the same," one banker said.

The move boosts CVC's contribution to 840 million euros or more from a standard 50 percent contribution of 700 million euros, the bankers said.

CVC was not immediately available for comment.

AB InBev, brewer of Budweiser, Stella and Beck's has said it wants $7 billion from divestments to repay $45 billion of loans for InBev's $52 billion takeover last year of U.S. brewer Anheuser-Busch.

The sale is expected to be financed with a 700 million euro leveraged loan and a vendor note from AB InBev, which will allow CVC to defer some of the purchase price until a later date.

CVC's increased equity contribution also decreases leverage on

...More Info

|

Mexico & United Kingdom: SABMiller seen as the most likely buyer of FEMSA’s beer unit

Mexico & United Kingdom: SABMiller seen as the most likely buyer of FEMSA’s beer unit

|

SABMiller Plc, world’s second-largest brewer, is seen as a front-runner to buy Mexico's No. 2 brewery, owned by FEMSA, Reuters reported on October, 2.

If the deal is closed, this will possibly draw SABMiller’s rival AB InBev into a showdown in Mexico’s lucrative market, experts believe.

FEMSA’s announcement of talks regarding its beer business has fuelled speculation Mexico could be the next country to be enveloped in the wave of beer industry consolidation of recent years.

According to sources close to the situation, FEMSA has spoken with Britain's SABMiller and Heineken from the Netherlands about a possible sale of its beer operation.

Analysts say SABMiller is in a better financial position than Heineken to bid for the FEMSA Cerveza beer unit of FEMSA, which also has soft-drink bottling and convenience store units.

"We think FEMSA Cerveza is the right fit only for SABMiller," UBS said in a report, adding that debt covenants would likely limit any bid by Heineken.

Buying FEMSA's beer unit would throw SABMiller into competition in Mexico against AB InBev, which owns half of Grupo Modelo, Mexico's No. 1 brewer and the maker of Corona.

FEMSA and Grupo Modelo account for nearly all of Mexico's beer industry, with sales of almost $5 billion

...More Info

|

Russia: Carlsberg should be able to take market share even if the beer tax is increased – Carlsberg CEO

Russia: Carlsberg should be able to take market share even if the beer tax is increased – Carlsberg CEO

|

Danish brewer Carlsberg could grow its Russian beer market share if a tax increase proposed by the Russian government takes effect, but the overall Russian beer market would shrink, Carlsberg's chief executive was quoted as saying by Reuters on October, 2.

“This would be bad for the total market but we should be able to take market share,” CEO Jorgen Rasmussen said by telephone.

The Russian Government last week moved to the State Duma a bill to increase excise duty on beer from next year by 200%. The bill also includes an increase in 2011 and 2012 by 11% and 20% respectively.

The bill will now be discussed in the State Duma and later in the Council of Federation before it can be referred to President Dmitry Medvedev for final approval and signing. This process can take several weeks.

Russia has begun a fresh round in its age-old battle against alcoholism. The draft law targets beer, an increasingly trendy drink in Russia but one that still lags far behind vodka in popularity. Many Russians doubt its alcoholic strength.

"Beer, if consumed in moderation and in the right circumstances, cannot lead to alcoholism," said Vladimir Kuznetsov of the Russian Beer Producers' Union.

Vodka accounted for 66%

...More Info

|

Russia & Ukraine: The shape of beer and malt industries leaves much to be desired

Russia & Ukraine: The shape of beer and malt industries leaves much to be desired

|

Beer and malt industries in Russia and the Ukraine are really in bad shape, a report communicated earlier this month.

Beer sales are sharply down, 10 % in Russia and even more in the Ukraine. The anti-alcohol drive of the Russian government threatens to cause a further downfall of the Russian beer market.

Malt stocks and purchases were even larger in these countries than in the EU at the beginning of the crisis. Nevertheless new factories came on stream in both countries.

Now the largest maltster, Russky Solod runs at half of its capacity, all others report a reduced production. Prices ex works Russia or FOB Baltic ports are between EUR 210,- and 225,- per ton.

|

United Kingdom: UK Office of Fair Trade reviewing Tennents’ lager deal, C&C says the transaction cannot be reversed

United Kingdom: UK Office of Fair Trade reviewing Tennents’ lager deal, C&C says the transaction cannot be reversed

|

The U.K. Office of Fair Trade said on October, 6 it's reviewing whether Irish drinks group C&C Group PLC's purchase of Tennents lager constitutes a merger situation that could reduce competition within the U.K. beer supply and distribution market, Dow Jones reported on the same day.

The deal with Tennents is part of C&C's central strategy to diversify away from cider and spirits. In August, C&C said it's buying the businesses of Anheuser-Busch InBev in Ireland, Northern Ireland and Scotland for GBP180 million.

The Irish drinks group played down the U.K. watchdog's announcement, however.

"This is a normal course of business for the OFT," a spokesman for C&C said. "The transaction was completed after shareholder approval and Irish Competition Authority approval. The transaction cannot be reversed."

The acquisition includes Tennents Lager, Scotland's leading lager brand where it accounts for 55% of volumes of lager sold on premises at pubs and restaurants in Scotland and around 30% of the Scottish off-trade market.

The deal also gives C&C distribution rights to certain Anheuser-Busch InBev brands in Ireland, Northern Ireland and Scotland, including Stella Artois and Beck's, which has attracted the interest of the U.K.'s OFT.

NCB Stockbrokers, which has a buy on C&C, said

...More Info

|

World: SABMiller to achieve significant earnings growth and increase volumes thanks to emerging markets - analysts

World: SABMiller to achieve significant earnings growth and increase volumes thanks to emerging markets - analysts

|

SABMiller can exist peacefully with its biggest rival, Belgium-based AB InBev, and achieve significant earnings growth, Morningstar communicated on October, 7.

SABMiller is a highly profitable wide-moat brewer with massive global scale and valuable assets in key markets. Although it recently lost its number-one spot after the Anheuser-Busch InBev combination, Morningstar analysts think the two giants can peacefully coexist in the world, and expect SABMiller, with its much more flexible balance sheet, to step up on the acquisition front to continue building out its scale.

SABMiller controls roughly 15% of global volume and was once the largest brewer in the world, until 2008 when second-place InBev acquired third-place Anheuser-Busch to control about one fourth of global volume. Still, SABMiller retains considerable scale. Six of the firm's brands are among the top 50 in the world, and the firm has the number-one or number-two spot in more than 90% of the markets in which it competes, including China, India, the United States, and South Africa. Its economies of scale allow it to generate robust profitability, with operating margins steadily above 20% during the last several years.

Unlike many other brewers in the world, SABMiller has considerable exposure to emerging markets, with roughly 64%

...More Info

|

Australia & United States: Australian GrainCorp to acquire the world’s fourth-largest maltster

Australia & United States: Australian GrainCorp to acquire the world’s fourth-largest maltster

|

Australia’s GrainCorp Ltd. has agreed to buy United Malt Holdings Ltd. for $655 million, doubling in size by adding the world’s fourth-largest manufacturer of malt, Bloomberg reported on October, 6.

The deal will be funded by selling A$589 million ($517 million) in new shares and $200 million in debt, Sydney-based GrainCorp, eastern Australia’s biggest grain handler, said in a presentation. The shares will be sold at 20 percent less than their closing price on October, 5.

Buying United Malt from buyout firms Castle Harlan Inc. and CHAMP Private Equity will give GrainCorp customers such as brewer Foster’s Group Ltd. along with operations in the U.S., the U.K. and Canada. It will also reduce GrainCorp’s reliance on seasonal cropping conditions in Australia.

“The deal would give GrainCorp more international diversification where currently it’s very exposed to the east coast weather,” said Hugh Dive, who helps manage about $3 billion at Investors Mutual Ltd. in Sydney, including GrainCorp stock. “We’re likely to see more consolidation in the agricultural sector.”

GrainCorp, halted from trading pending the stock sale at A$5.65 each, fell 3.5 percent to A$7.092 when last traded on October, 5, giving it a market value of A$681 million. The share sale is underwritten

...More Info

|

World: Barley crop 2009 comes out very large despite all obstacles

World: Barley crop 2009 comes out very large despite all obstacles

|

This is not only a year of another very large grain crop in the world, it is also a year of great crop concerns early in the season in the Northern hemisphere, turning into perfect crops during summer and often enough almost “last minute“, an analysts’ report summed up on October, 2.

In Europe the superb French crop was followed by very large and good crops in Germany, Scandinavia, Poland and the U.K. (quality problems in Scotland were a minor problem, when compared to the total crop).

Barley and other crops in Russia and the Ukraine were not as good as last year, but better than forecast a few months ago.

In the U.S. there was a bad beginning in spring, but finally corn and soybeans produced record yields.

In Canada it almost looked like a crop failure, before August rains and September sunshine saved the barley crop.

Weather in Australia has not turned into an El Nino system yet and gives all hope for a reasonable wheat and barley crop.

It started to rain even in Argentina, and we may see a surprise from that country as well, experts commented.

|

EU: Barley prices below intervention level, export almost non-existent

EU: Barley prices below intervention level, export almost non-existent

|

EU’s intervention purchases only commence in November, intervention prices are subject to strict regulations and payments are late. Therefore present market prices are below the intervention level, close to EUR 90,- ex silos in the interior of France and Germany. Prices delivered seaports are EUR 98,- in France and 100,- in Germany, both basis October, market sources report.

Export business is almost non-existent, it is estimated that the small export licence bookings of 285,000 tons since the 1st of July are to be divided into 150,000 tons or more for malting barley and little more than 100,000 tons for feed barley.

As the downside of EU feed barley offers is blocked by the intervention system after all, the barley cannot be competitive with the Black Sea, experts commented.

There are initial estimates of huge intervention purchases as of November, above all in Central-East Europe and in Scandinavia, figures of 2 -3 million tons seem entirely possible, analysts believe.

|

China: China was the largest importer of malting barley in Jan/Aug this year

China: China was the largest importer of malting barley in Jan/Aug this year

|

This year, China is the largest importer of malting barley, industry analysts reported at the beginning of October. During Jan/August the country imported 1.3 mln tons, of which 658,000 tons from Australia, 395,000 tons from Canada and 254,000 tons from France.

The EU, i.e. France, had been very competitive during the past months, vague estimates of EU sales range from 250 to 400,000 tons for the crop year 2009/10, and total sales prospects are put at 400 to 600,000 tons.

EU sellers are hurt by the Euro/dollar exchange rate, and a sharp increase of container freight rates to China, from approx. US$400,- to 600,- per container. Bulk freight France-China costs US$ 50,-/55,- per ton, it is reported.

Meantime Canada sold 60,000 tons at a reported price of US$ 230,- CIF. Australia has always been the No.1 seller to China and will certainly offer new crop barley competitively. Initial sales have been done, reported prices are in the range of US$ 220,- to 230,-.

|

Beer Lightstruck Flavor: The Full Story

Beer Lightstruck Flavor: The Full Story

Denis DE KEUKELEIRE, Arne HEYERICK, Kevin HUVAERE, Leif H. SKIBSTED and Mogens L. ANDERSEN

Abstract:

The pronounced sensitivity of beer to light is well known

and leads irreversibly to the formation of lightstruck flavor

(LSF), the so-called “skunking” of beer. It is the cause of a

significant shelf-life problem for the brewing industry and

is the primary reason for the storage of beer in darkcolored

containers. The light-sensitivity of beers was first

recognized as early as in 1875, however it was not until

the early sixties that the basic science underlying the

formation of LSF was established. Studies using model

systems showed that LSF was produced in a non-enzymic

light-induced reaction involving riboflavin (1) (as a

sensitizer), a suitable sulfur-containing compound, and

isohumulones, the main beer-bittering principles. The

typical skunky flavor was attributed to the formation of 3-

methylbut-2-ene-1-thiol (MBT), a pungent off-flavor in

beer with a flavor threshold of few ng per litre. Later it

was shown that also direct UV irradiation of isohumulones

affords radical precursors of MBT. Still, the exact reaction

mechanism remained elusive until recent detailed

investigations. Herein, the mechanistic details for the

formation of LSF in beer are comprehensively reviewed.

Cerevisia, 33(3) 2008

Load full article from site www.cerevisia.eu

|

| EURO = USD 1.471 October 07, 2009 |

| Crop year |

2009 |

2010 |

| Parity |

FOB Creil |

FOB Creil |

| Position |

July 2009 |

July 2010 |

| Type |

Variety |

EURO |

USD |

EURO |

USD |

| 2RS |

Scarlett |

97.00 |

143.00 |

118.00 |

173.50 |

| 2RS |

Prestige |

96.00 |

141.50 |

117.00 |

172.50 |

| 2RS |

Cellar |

95.00 |

140.00 |

116.00 |

171.00 |

| 2RS |

Sebastien |

94.00 |

138.50 |

115.00 |

169.50 |

| 2RS |

Tipple |

94.00 |

138.50 |

115.00 |

169.50 |

| 2RS |

Henley |

94.00 |

138.50 |

115.00 |

169.50 |

| 6RW |

Esterel |

96.00 |

141.50 |

109.00 |

160.50 |

French Feed Barley Prices. Nominal prices

| EURO = USD 1.471 October 07,2009 |

| Crop year |

2009 |

| Parity |

FOB Creil |

| Position |

July 2009 |

| Type |

EURO |

USD |

| Feed Barley |

89.00 |

130.92 |

| EURO = USD 1.471 October 07, 2009 |

| Crop year |

2009 |

| Parity |

FOB Antwerp |

| Position |

Oct 2009 - Sept 2010 |

| Conditioning |

Bulk |

In bags |

Bulk containers |

Bags, containers |

| Malting barley variety |

EURO |

USD |

EURO |

USD |

EURO |

USD |

EURO |

USD |

| 2RS |

Scarlett |

283.50 |

417.00 |

314.50 |

463.00 |

307.00 |

451.50 |

321.50 |

472.50 |

| 2RS |

Prestige |

282.50 |

415.50 |

313.50 |

461.00 |

306.00 |

450.00 |

320.00 |

470.50 |

| 2RS |

Cellar |

281.00 |

413.50 |

312.50 |

459.50 |

304.50 |

448.00 |

319.00 |

469.00 |

| 2RS |

Sebastien |

280.00 |

411.50 |

311.00 |

457.50 |

303.50 |

446.00 |

317.50 |

467.00 |

| 2RS |

Tipple |

280.00 |

411.50 |

311.00 |

457.50 |

303.50 |

446.00 |

317.50 |

467.00 |

| 2RS |

Henley |

280.00 |

411.50 |

311.00 |

457.50 |

303.50 |

446.00 |

317.50 |

467.00 |

| 2RS |

Average price |

281.00 |

413.50 |

312.50 |

459.50 |

304.50 |

448.00 |

319.00 |

469.00 |

| 6RW |

Esterel |

281.50 |

415.50 |

313.50 |

461.00 |

306.00 |

450.00 |

320.00 |

470.50 |

| * |

Asia Malt 70/30 |

281.50 |

414.00 |

312.50 |

460.00 |

305.00 |

448.50 |

319.50 |

469.50 |

| ** |

Asia Malt 50/50 |

281.50 |

414.50 |

313.00 |

460.00 |

305.50 |

449.00 |

319.50 |

470.00 |

| EURO = USD 1.471 October 07, 2009 |

| Crop year |

2010 |

| Parity |

FOB Antwerp |

| Position |

Oct 2010 - Sept 2011 |

| Conditioning |

Bulk |

In bags |

Bulk containers |

Bags, containers |

| Malting barley variety |

EURO |

USD |

EURO |

USD |

EURO |

USD |

EURO |

USD |

| 2RS |

Scarlett |

309.50 |

454.50 |

340.50 |

500.50 |

332.50 |

489.50 |

347.00 |

510.50 |

| 2RS |

Prestige |

308.00 |

453.00 |

339.00 |

499.00 |

331.50 |

487.50 |

345.50 |

508.50 |

| 2RS |

Cellar |

306.50 |

451.00 |

338.00 |

497.00 |

330.50 |

485.50 |

344.50 |

506.50 |

| 2RS |

Sebastien |

305.50 |

449.50 |

336.50 |

495.50 |

329.00 |

484.00 |

343.50 |

505.00 |

| 2RS |

Tipple |

305.50 |

449.50 |

336.50 |

495.50 |

329.00 |

484.00 |

343.50 |

505.00 |

| 2RS |

Henley |

305.50 |

449.50 |

336.50 |

495.50 |

329.00 |

484.00 |

343.50 |

505.00 |

| 2RS |

Average price |

306.50 |

451.00 |

338.00 |

497.00 |

330.50 |

485.50 |

344.50 |

506.50 |

| 6RW |

Esterel |

297.00 |

438.50 |

329.50 |

484.50 |

321.50 |

473.00 |

336.00 |

494.00 |

| * |

Asia Malt 70/30 |

304.00 |

447.50 |

335.50 |

493.50 |

327.50 |

482.00 |

342.00 |

503.00 |

| ** |

Asia Malt 50/50 |

302.50 |

445.00 |

333.50 |

490.50 |

326.00 |

479.50 |

340.00 |

500.50 |

NB: Prices published are theoretical malt prices including financial cost,

THC (for bulk and bags container) and all administrative costs.

This prices may fluctuate according to the quantity per delivery

and technical specifications.

* - 70/30 = 70% Average two Rows Spring and 30% Six Rows Winter

** - 50/50 = 50% Average two Rows Spring and 50% Six Rows Winter

Australian Barley Supply and Disposal

| |

2007-2008 |

2008-2009s |

2009-2010f |

| Production |

7159 |

6820 |

7898 |

| Domestic use |

2460 |

2523 |

2582 |

| as malt and other human use |

165 |

169 |

173 |

| feed |

2100 |

2153 |

2206 |

| seed |

195 |

202 |

203 |

| Exports |

4053 |

4141 |

4268 |

| as malting barley |

1083 |

920 |

989 |

| malt (grain equivalent) |

668 |

642 |

674 |

| feed barley |

2303 |

2579 |

2605 |

s - ABARE estimated, f - ABARE forecast. Source - ABARE September, 2009

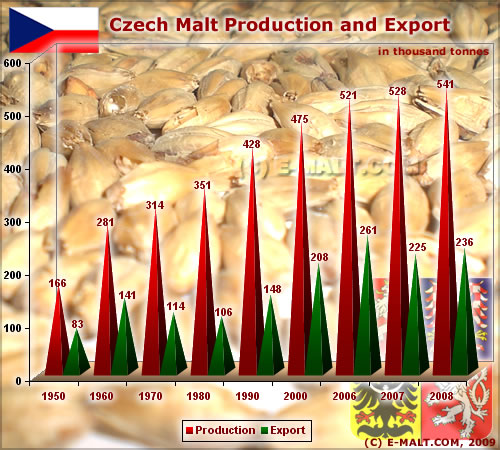

Source: The Czech Union of Breweries and Malt-Houses

October 05

1887 Rene Cassin is born, pacifist, Nobel Peace Prize 1968

1993 Daimler-Benz becomes the first German company to be listed on the New York Stock Exchange

1902 Ray Kroc, born in Illinois, founder of McDonalds and owner of the San Diego Padres

October 06

1781 Benjamin Hanks patents self-winding clock

1889 Thomas Edison shows his 1st motion picture

October 07

1806 Carbon paper patented in London by inventor Ralph Wedgewood

1910 Henry Ford institutes moving assembly line

1930 1st infra-red photograph, Rochester, NY

| |

Copyright © E-Malt s.a. 2009

|