Newsletter Summary

Currency rates

Currency rates

Equities of largest breweries

Equities of largest breweries

Market prices change trend

Market prices change trend

Brewery news

Brewery news

Malt news

Malt news

Barley news

Barley news

More news

More news

Theoretical malt prices

Theoretical malt prices

Malting barley prices

Malting barley prices

Table of the week

Table of the week

Graph of the week

Graph of the week

On These Days

On These Days

Agenda

Agenda

Do you know e-malt.com?

Do you know e-malt.com?

Average market prices

Change trend

Note:

Just click on the price link and you will be led to our

Market Price History. Average barley market prices are French and are estimated on FOB Creil basis.

Average Malt Prices are theoretical and based FOB Antwerp being estimated on French malting .

The changes are compared to last Newsletter's prices.

Arrows indicate the direction of the change.

Easy E-malt.com

Access to E-malt.com

Use the above form to have a full immediate access to E-malt.com site!

Through the drop-down menu you can easily remind your username and password;

change your username and password or even edit your account!

Do you know

E-malt.com ?

Dear E-malt Reader!

E-malt.com Newsletters Archive could be found directly on

e-malt.com site.

Browsing through our Newsletters' Archive you may see all the issues you have missed. To this purpose you just have to

login e-malt.com and click on Newsletters link in the menu. Reading our Newsletters

you will be kept informed with the latest news and events regarding malting and beer

world. You may also submit your own news, events or other information to the address

info@e-malt.com!

Updated figures related to USA barley and malt trade with Mexico and Canada could be seen in NAFTA section of e-malt.com menu. To this purpose please enter

e-malt.com!

You may find updated malt, barley and beer statistics on e-malt.com Statistics section. Just enter e-malt.com! Here you will find all tables issued with e-malt.com newsletters.

E-malt.com Agenda gives the possibility to keep you informed about the Events planned to be held in the whole world related to the brewing and malting industries. To this purpose you just have to login e-malt.com and click on Agenda link in the menu. Reading our Event Agenda you will find out about the future symposia, conferences and festivals related to malting and beer world. You may also submit your own events to the address info@e-malt.com

E-malt.com has Trading Online system. The system is to be used for malt/barley trading. One can register a malt/barley offer or a malt/barley request. The registering person could be as a seller/buyer or as an agent for seller/buyer.

The User can see information about all active malt/barley offers & requests. If needed the system allows user to buy/sell malt/barley due to reasonable offers/requests. The way to do this is to confirm reasonable transaction.

Trading Online rules are available through the Internet in the Trading Online as well as Tutorial (useful for persons who starts the system usage).

To visit the E-malt Trading Online first go to the E-malt.com site, then click Trading Online link in the left menu of the e-malt.com home page. For more details please contact info@e-malt.com

Thank You!

E-malt.com Links!

Other e-malt.com newsletters

Last five newsletters

Newsletter 16a, 2007

Newsletter 15b, 2007

Newsletter 15a, 2007

Newsletter 14b, 2006

Newsletter 14a, 2007

Market price evolutions

The evolution of market prices for barley and malt, which are periodically issued with e-malt.com newsletters are published on e-malt.com site in Market Prices section. Just click here!

Available market price evolutions

E-malt.com graphs

All graphs issued with e-malt.com newsletters are published in "Graph" section of e-malt.com site.

Last five graphs

Per capita Beer Consumption in Eastern Europe 2006e

Ukraine Barley Production and Export

China Beer Production

Malt Exports of Czech Republic (1993 - 2006)

Brazil Beer Production (1995 - 2006e)

The graphs are updated from time to time. Just see the updates online on

e-malt.com site !

All e-malt.com tables are published in e-malt.com Statistics section.

The Statistics section includes Barley statistics, Malt statistics and Beer statistics.

The tables related to barley are published in Barley Statistics section, the tables related

to malt in Malt Statistics section and the tables related to beer in Beer Statistics section.

Note

If you have any comments, questions, suggestions or remarks,

you can send a mail to: info@e-malt.com.

To submit your own news to our editorial team, email to:

info@e-malt.com

If you have received this newsletter from a colleague, you can obtain your own

subscription here! You are not registered yet? You may register here.

You may recommend our site to your friend

by clicking here

If you do not wish to receive our newsletter, please unsubscribe your e-mail address

from our mailing list by sending us an e-mail info@e-malt.com. Please take into consideration your registration data .

|

|

E-malt.com Newsletter 16b

April 19 - April 22, 2007

Quote of the week

"Brewers enjoy working to make beer as much as drinking beer instead of working."

Harold Rudolph

Currency Rates Currency Rates

Base Currency: Euro, EUR

on 20-April-2007

1 EUR = 1.3598 USD

1 EUR = 0.6787 GBP

1 EUR = 1.5346 CAD

1 EUR = 1.6299 AUD

1 EUR = 160.691 JPY

1 EUR = 2.7692 BRL

1 EUR = 35.0167 RUB

1 EUR = 10.5074 CNY

|

Base Currency: US Dollar

on 20-April-2007

1 USD = 0.7355 EUR

1 USD = 0.4991 GBP

1 USD = 1.1286 CAD

1 USD = 1.1986 AUD

1 USD = 118.179 JPY

1 USD = 2.0365 BRL

1 USD = 25.751 RUB

1 USD = 7.7271 CNY

|

|

EUR/USD Chart

|

|

Equities of the Largest Breweries

Top Industry News

Top Industry News

|

Hong Kong: Tsingtao says H2 earnings jump 76.9%...

Click here

|

|

Belgium: AmBev’s voluntary offer to purchase all Quilmes Industrial’s outstanding shares expired...

Click here

|

|

Czech Republic: Budejovicky Budvar welcomes EU’s ruling against Anheuser-Busch...

Click here

|

|

Philippines: Asia Brewery considered to be taken public...

Click here

|

|

Estonia: Saku ends Q1 with exceptional sales...

Click here

|

|

Canada: Molson Coors shares reached a record $97 after merger...

Click here

|

|

EU: There was no spectacular malt purchase action reported during March...

Click here

|

|

EU: Maltsters booked export licences 260,000 tonnes less than a year ago...

Click here

|

|

EU: Even feed barley supplies of crop 2006 are very tight in the EU...

Click here

|

|

Canada: CWB malting barley prices down CA$8/t...

Click here

|

|

EU: Old crop barley is appearing in the market in bits and pieces...

Click here

|

|

More News More News

|

France: Barley sowings in slight increase

...

More Info

|

|

Russia: Feed barley prices to surge

...

More Info

|

|

UK: Globalisation threatens Scottish & Newcastle

...

More Info

|

|

Chile: Compañía Cervecerías Unidas (CCU) announces board election and payment of definitive dividend

...

More Info

|

|

UK: Specialist Brand Development signs exclusive deal to import Japanese brand Sapporo to the island

...

More Info

|

|

Australia: Coopers Premium Lager wins gold medals again

...

More Info

|

|

Finland: Baltika №6 Porter - silver medallist of Helsinki Beer Festival

...

More Info

|

|

USA: Another objection to Pittsburgh Brewing’s bankruptcy plan

...

More Info

|

|

Russia: Success of 2006 allowed Baltika to double the project capacities of the brewery in Novosibirsk

...

More Info

|

|

Netherlands: Heineken N.V. General Meeting of Shareholders adopts all proposals on agenda

...

More Info

|

|

Nigeria: Champion Breweries gets ISO - 9001 -2000

...

More Info

|

|

USA: Beer tax to be raised in Oregon

...

More Info

|

|

UK: Tony Blair lobbied to bring back stamps on beer glasses

...

More Info

|

|

Brewery News Brewery News

Malt News Malt News

Barley News Barley News

Malting barley prices. French barley prices.

Nominal prices.

| EURO = USD 1.3598 April 20, 2007 |

| Crop year |

2006 |

2007 |

| Parity |

FOB Creil |

FOB Creil |

| Position |

July 2006 |

July 2007 |

| Type |

Variety |

EURO |

USD |

EURO |

USD |

| 2RS |

Scarlett |

205.00 |

279.00 |

176.00 |

239.50 |

| 2RS |

Prestige |

204.00 |

277.50 |

175.00 |

238.00 |

| 2RS |

Cellar |

203.00 |

276.50 |

174.00 |

237.00 |

| 2RS |

Sebastien |

202.00 |

275.00 |

173.00 |

235.50 |

| 2RS |

Astoria |

202.00 |

275.00 |

173.00 |

235.50 |

| 2RS |

Cork |

202.00 |

275.00 |

172.00 |

234.00 |

| 6RW |

Esterel |

173.00 |

235.50 |

151.00 |

205.50 |

Theoretical malt prices.

| EURO = USD 1.3598 April 20, 2007 |

| Crop year |

2006 |

| Parity |

FOB Antwerp |

| Position |

Apr 2007-Sept 2007 |

| Conditioning |

Bulk |

In bags |

Bulk containers |

Bags, containers |

| Malting barley variety |

EURO |

USD |

EURO |

USD |

EURO |

USD |

EURO |

USD |

| 2RS |

Scarlett |

423.50 |

575.50 |

446.00 |

606.50 |

440.00 |

598.00 |

450.50 |

612.50 |

| 2RS |

Prestige |

422.00 |

574.00 |

445.00 |

604.50 |

438.50 |

596.50 |

449.00 |

610.50 |

| 2RS |

Cellar |

421.00 |

572.00 |

443.50 |

603.00 |

437.50 |

594.50 |

448.00 |

609.00 |

| 2RS |

Sebastien |

419.50 |

570.50 |

442.50 |

601.50 |

436.00 |

593.00 |

446.50 |

607.50 |

| 2RS |

Astoria |

419.50 |

570.50 |

442.50 |

601.50 |

436.00 |

593.00 |

446.50 |

607.50 |

| 2RS |

Cork |

419.50 |

570.50 |

442.50 |

601.50 |

436.00 |

593.00 |

446.50 |

607.50 |

| 2RS |

Average price |

421.00 |

572.00 |

443.50 |

603.00 |

437.50 |

594.50 |

448.00 |

609.00 |

| 6RW |

Esterel |

383.00 |

522.00 |

406.50 |

553.00 |

400.50 |

544.50 |

411.00 |

559.00 |

| * |

Asia Malt 70/30 |

409.50 |

557.00 |

432.50 |

588.00 |

426.50 |

579.50 |

437.00 |

594.00 |

| ** |

Asia Malt 50/50 |

402.50 |

547.00 |

425.00 |

578.00 |

419.00 |

569.50 |

429.50 |

584.00 |

| EURO = USD 1.3598 April 20, 2007 |

| Crop year |

2007 |

| Parity |

FOB Antwerp |

| Position |

Oct 2007-Sept 2008 |

| Conditioning |

Bulk |

In bags |

Bulk containers |

Bags, containers |

| Malting barley variety |

EURO |

USD |

EURO |

USD |

EURO |

USD |

EURO |

USD |

| 2RS |

Scarlett |

367.00 |

499.00 |

390.00 |

530.00 |

383.50 |

521.50 |

394.50 |

536.00 |

| 2RS |

Prestige |

366.00 |

497.50 |

388.50 |

528.50 |

382.50 |

520.00 |

393.00 |

534.50 |

| 2RS |

Cellar |

364.50 |

496.00 |

387.50 |

527.00 |

381.50 |

518.50 |

392.00 |

532.50 |

| 2RS |

Sebastien |

363.50 |

494.00 |

386.50 |

525.00 |

380.00 |

516.50 |

390.50 |

531.00 |

| 2RS |

Astoria |

363.50 |

494.00 |

386.50 |

525.00 |

380.00 |

516.50 |

390.50 |

531.00 |

| 2RS |

Cork |

362.50 |

492.50 |

385.00 |

523.50 |

378.50 |

515.00 |

389.50 |

529.50 |

| 2RS |

Average price |

364.50 |

495.50 |

387.50 |

526.50 |

381.00 |

518.00 |

391.50 |

532.50 |

| 6RW |

Esterel |

335.50 |

457.50 |

359.00 |

488.50 |

353.00 |

480.00 |

363.50 |

494.50 |

| * |

Asia Malt 70/30 |

356.00 |

484.00 |

194.00 |

515.00 |

187.50 |

506.50 |

198.50 |

521.00 |

| ** |

Asia Malt 50/50 |

350.50 |

476.50 |

194.00 |

507.50 |

187.50 |

499.00 |

198.50 |

513.50 |

NB: Prices published are theoretical malt prices including financial cost,

THC (for bulk and bags container) and all administrative costs.

This prices may fluctuate according to the quantity per delivery and technical specifications.

* - 70/30 = 70% Average two Rows Spring and 30% Six Rows Winter

** - 50/50 = 50% Average two Rows Spring and 50% Six Rows Winter

Table of the week

Europe Barley Crop Estimate 2006 and Forecast 2007

| Country |

Year |

BARLEY |

thereof SPRING BARLEY |

| |

|

Area

1000 ha |

Yield

100kg/ha |

Production

1000 t |

Area

1000 ha |

Yield

100kg/ha |

Production

1000 t |

| Austria |

2006 |

206 |

44.3 |

913 |

142 |

41.3 |

586 |

| 2007 |

190 |

48.7 |

925 |

120 |

45.0 |

540 |

| Belgium/Lux. |

2006 |

55 |

77.4 |

426 |

9 |

59.0 |

50 |

| 2007 |

58 |

75.0 |

435 |

8 |

61.0 |

49 |

| Denmark |

2006 |

677 |

48.0 |

3 353 |

519 |

45.5 |

2 361 |

| 2007 |

630 |

52.6 |

3 314 |

470 |

50.0 |

2 350 |

| Finland |

2006 |

564 |

34.0 |

1 918 |

564 |

34.0 |

1 918 |

| 2007 |

555 |

33.0 |

1 832 |

555 |

33.0 |

1 832 |

| France |

2006 |

1 662 |

62.7 |

10 421 |

493 |

57.1 |

2 815 |

| 2007 |

1 718 |

64.8 |

11 133 |

525 |

59.0 |

3 098 |

| Germany |

2006 |

2 025 |

59.1 |

11 968 |

542 |

46.4 |

2 515 |

| 2007 |

2 029 |

61.6 |

12 499 |

555 |

50.0 |

2 775 |

| Greece |

2006 |

170 |

16.0 |

272 |

|

|

|

| 2007 |

255 |

18.0 |

459 |

|

|

|

| Ireland |

2006 |

157 |

69.0 |

1 083 |

144 |

70.0 |

1 008 |

| 2007 |

168 |

72.0 |

1 210 |

151 |

70.0 |

1 057 |

| Italy |

2006 |

325 |

37.5 |

1 219 |

|

|

|

| 2007 |

310 |

38.0 |

1 178 |

|

|

|

| Netherlands |

2006 |

44 |

61.2 |

269 |

41 |

60.7 |

249 |

| 2007 |

47 |

61.3 |

288 |

45 |

61.0 |

275 |

| Portugal |

2006 |

41 |

23.0 |

94 |

|

|

|

| 2007 |

30 |

21.0 |

63 |

|

|

|

| Spain |

2006 |

3 136 |

25.8 |

8 091 |

2 370 |

26.2 |

6 209 |

| 2007 |

3 220 |

25.6 |

8 243 |

2 520 |

26.0 |

6 552 |

| Sweden |

2006 |

307 |

36.2 |

1 111 |

301 |

36.0 |

1 084 |

| 2007 |

348 |

41.7 |

1 451 |

340 |

41.5 |

1 411 |

| U.K. |

2006 |

878 |

59.4 |

5 215 |

494 |

53.2 |

2 628 |

| 2007 |

878 |

59.9 |

5 259 |

510 |

55.0 |

2 805 |

| TOTAL EU-15 |

2006 |

10 247 |

45.1 |

46 253 |

5 619 |

38.1 |

21 424 |

| 2007 |

10 436 |

46.3 |

48 288 |

5 799 |

39.2 |

22 742 |

| Cyprus |

2006 |

50 |

22.0 |

50 |

|

|

|

| 2007 |

50 |

22.0 |

50 |

|

|

|

| Czech Rep. |

2006 |

529 |

37.5 |

1 984 |

426 |

37.0 |

1 576 |

| 2007 |

525 |

41.2 |

2 163 |

415 |

41.0 |

1 702 |

| Estonia |

2006 |

138 |

21.4 |

295 |

137 |

21.4 |

293 |

| 2007 |

131 |

24.0 |

314 |

130 |

24.0 |

312 |

| Hungary |

2006 |

300 |

38.0 |

1 140 |

122 |

36.0 |

439 |

| 2007 |

305 |

38.4 |

1 171 |

125 |

37.5 |

469 |

| Latvia |

2006 |

152 |

16.1 |

245 |

148 |

16.0 |

237 |

| 2007 |

148 |

20.1 |

297 |

145 |

20.0 |

290 |

| Lithuania |

2006 |

381 |

22.0 |

838 |

295 |

23.0 |

679 |

| 2007 |

371 |

25.1 |

931 |

365 |

25.0 |

913 |

| Malta |

2006 |

1 |

26.0 |

3 |

|

|

|

| 2007 |

1 |

26.0 |

3 |

|

|

|

| Poland |

2006 |

1 221 |

26.8 |

3 272 |

1 066 |

25.5 |

2 718 |

| 2007 |

1 200 |

31.1 |

3 732 |

1 050 |

30.2 |

3 171 |

| Slovakia |

2006 |

186 |

36.7 |

683 |

167 |

37.0 |

618 |

| 2007 |

190 |

37.8 |

703 |

160 |

37.0 |

592 |

| Slovenia |

2006 |

18 |

38.0 |

68 |

|

|

|

| 2007 |

17 |

36.6 |

61 |

|

|

|

| TOTAL EU-10 |

2006 |

2 975 |

28.8 |

8 571 |

2 361 |

27.8 |

6 560 |

| 2007 |

2 939 |

32.1 |

9 433 |

2 390 |

31.2 |

7 448 |

| TOTAL EU-25 |

2006 |

13 222 |

41.5 |

54 823 |

7 980 |

35.1 |

27 984 |

| 2007 |

13 375 |

43.2 |

57 721 |

8 189 |

36.9 |

30 190 |

| Romania |

2006 |

330 |

21.9 |

723 |

200 |

19.3 |

386 |

| 2007 |

320 |

23.6 |

755 |

170 |

21.0 |

357 |

| Bulgaria |

2006 |

210 |

24.5 |

515 |

25 |

20.0 |

50 |

| 2007 |

190 |

29.8 |

566 |

25 |

25.5 |

64 |

| Serbia |

2006 |

95 |

29.1 |

276 |

45 |

31.0 |

140 |

| 2007 |

100 |

29.6 |

296 |

65 |

32.0 |

208 |

| Croatia |

2006 |

59 |

35.5 |

209 |

|

|

|

| 2007 |

50 |

35.0 |

175 |

|

|

|

| Bosnia |

2006 |

20 |

25.0 |

50 |

|

|

|

| 2007 |

15 |

24.5 |

37 |

|

|

|

| Macedonia |

2006 |

35 |

25.0 |

88 |

|

|

|

| 2007 |

35 |

25.0 |

88 |

|

|

|

| Albania |

2006 |

10 |

30.0 |

30 |

|

|

|

| 2007 |

10 |

30.0 |

30 |

|

|

|

| TOTAL Non - EU |

2006 |

219 |

29.8 |

653 |

45 |

31.0 |

140 |

| 2007 |

210 |

29.8 |

625 |

65 |

32.0 |

208 |

| TOTAL EUROPE 31 |

2006 |

13 981 |

40.6 |

56 714 |

8 250 |

34.6 |

28 559 |

| 2007 |

14 095 |

42.3 |

59 668 |

8 449 |

36.5 |

30 819 |

Source: COCERAL, Brussels, March, 2007

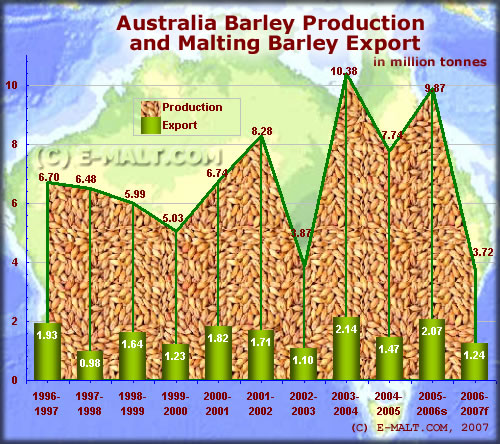

Graph of the week

Source: ABARE February, 2007

These Days in Business History

April 19

1662 Royal Society incorporates

1940 1st electron microscope demonstrated (RCA),

1948 ABC-TV network begins April 20

1926 1st check sent by radio facsimile transmission across Atlantic

1948 1st Polaroid camera was sold in US

1973 Canadian ANIK A2 becomes 1st commercial satellite in orbit

April 21

1654 England and Sweden sign trade agreement

1982 Dr. Michael E. Bakey performs 1st successful heart implant

1983 1 pound coin introduced in United Kingdom

April 22

1924 Hague Chambers of Commerce forms

1969 1st human eye transplant performed

1991 Intel releases 486SX chip

|

Agenda

April 2007:

InterFood St. Petersburg

15th Annual International Beer Festival, USA.

The International Hop Growers’ Convention (IHGC) Meetings, France.

24th ANNUAL INTERNATIONAL BEER FESTIVAL SAN FRANCISCO

May 2007:

European Grain & Oilseed Convention 2007, Brussels

31-st International Congress of the European Brewery Convention , Italy

Hofex - 2007, China

InterFood Azerbaijan 13th Azerbaijan International Food Industry and Agriculture Exhibition

InterFood Astana , Kazakhstan, 9th Astana International Exhibition for Food, Beverages, Technologies

June 2007:

Japan-Asia Beer Cup 2007, Tokyo

InterFood Mongolia

IGC Grains Conference 2007 London, England

Great Japan Beer Festival 2007 in Tokyo

Brasil Brau 2007

The International Hop Growers’ Convention(IHGC)

Practical Course on Malt and Malting Barley Canada

The 5th Canadian Barley Symposium & District Western Canada MBAA

Seattle International Beer Festival

More events are available on site e-malt.com

|

|

|

Copyright © E-Malt s.a. 2007

|

|