|

Newsletter Summary

Last five newsletters

Last five graphs

Note: All graphs issued with e-malt.com newsletters

are published in "Graph" section

of e-malt.com site.

Last five tables

All e-malt.com tables are published in e-malt.com Statistics section. The Statistics section includes Barley statistics, Malt statistics and Beer statistics. The tables related to barley are published in Barley Statistics section, the tables related to malt in Malt Statistics section and the tables related to beer in Beer Statistics section.

Last five prices evolutions

Last five scintific digests

Access to E-malt.com

Use the above form to have a full immediate access to E-malt.com site!

Through the drop-down menu you can easily remind your username and password,

change your username and password or even edit your account!

Do you know

E-malt.com?

Dear E-malt Reader!

E-malt.com Newsletters Archive could be found directly on

e-malt.com site.

Browsing through our Newsletters Archive you may see all the issues you have missed.

To this purpose you just have to login e-malt.com and click on Newsletters link in the menu.

Reading our Newsletters you will be kept informed with the latest news and events regarding malting and beer world.

You may also submit your own news, events or other information to the address

info@e-malt.com!

Updated figures related to USA barley and malt trade with Mexico and Canada

could be seen in NAFTA section of e-malt.com menu.

To this purpose please enter e-malt.com!

You may find updated malt, barley and beer statistics on e-malt.com

Statistics section.

Just enter e-malt.com!

Here you will find all tables issued with e-malt.com newsletters.

E-malt.com Agenda gives the possibility to keep you informed about the Events

planned to be held in the whole world related to the brewing and malting

industries. To this purpose you just have to login

e-malt.com

and click on Agenda link in the menu. Reading our Event Agenda you will find

out about the future symposia, conferences and festivals related to malting and

beer world. You may also submit your own events to the address

info@e-malt.com

E-malt.com has Trading Online system. The system is to be used for

malt/barley trading. One can register a malt/barley offer or a malt/barley

request. The registering person could be as a seller/buyer or as an agent for

seller/buyer. The User can see information about all active malt/barley offers

& requests. If needed the system allows user to buy/sell malt/barley due to

reasonable offers/requests. The way to do this is to confirm reasonable

transaction. Trading Online rules are available through the Internet in the

Trading Online as well as Tutorial (useful for persons who starts the system

usage). To visit the E-malt Trading Online first go to the E-malt.com site,

then click Trading Online link in the left menu of the e-malt.com home page.

For more details please contact info@e-malt.com

Thank You!

E-malt.com Links!

Note

If you have any comments, questions, suggestions or remarks, you can send a

mail to: info@e-malt.com.

To submit your own news to our editorial team, email to:

info@e-malt.com

If you have received this newsletter from a colleague, you can obtain your own

subscription here!

You are not registered yet? You may register

here.

You may recommend our site to your friend

by clicking here.

If you do not wish to receive our newsletter, please unsubscribe your

e-mail address from our mailing list by sending us an e-mail

info@e-malt.com.

Please take into consideration your registration data.

|

Click here to get full size Newsletter

"Any man who selects a goal in life which can be fully achieved has already defined his own limitations."

Cavett Robert

Base Currency: Euro, EUR

on 08-May-2008

1 EUR = 1.5464 USD

1 EUR = 0.788 GBP

1 EUR = 1.5519 CAD

1 EUR = 1.6337 AUD

1 EUR = 162.436 JPY

1 EUR = 2.5807 BRL

1 EUR = 36.7958 RUB

1 EUR = 10.8206 CNY

| Base Currency: US Dollar

on 08-May-2008

1 USD = 0.6467 EUR

1 USD = 0.5096 GBP

1 USD = 1.0036 CAD

1 USD = 1.0565 AUD

1 USD = 105.048 JPY

1 USD = 1.6688 BRL

1 USD = 23.7948 RUB

1 USD = 6.9974 CNY

|  |

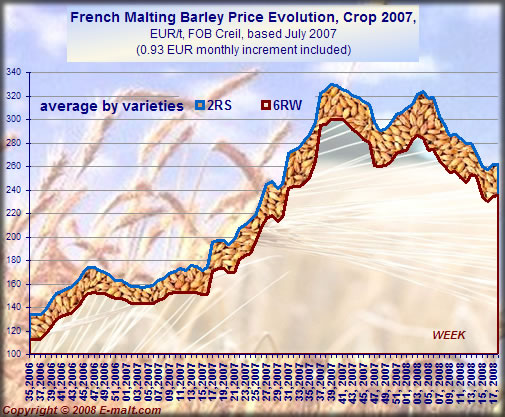

Note:

Just click on the price link and you will be led to our Market

Price History. Average barley market prices are French and are

estimated on FOB Creil basis.

Average Malt Prices are theoretical and based FOB Antwerp being

estimated on French malting barley.

The changes are compared to last Newsletter's

prices. Arrows indicate the direction of the change.

Belgium: InBev Q1 disappoints but fundamentals remain unchanged

...Click here

Belgium: InBev Q1 disappoints but fundamentals remain unchanged

...Click here

|

India: SABMiller to invest $500 million in India in five years to increase production capacity

...Click here

India: SABMiller to invest $500 million in India in five years to increase production capacity

...Click here

|

Ukraine: SABMiller to buy Ukrainian brewer CJSC Sarmat

...Click here

Ukraine: SABMiller to buy Ukrainian brewer CJSC Sarmat

...Click here

|

Denmark: Carlsberg to grow Kronenbourg beer’s profitability

...Click here

Denmark: Carlsberg to grow Kronenbourg beer’s profitability

...Click here

|

Europe: Lower barley prices slow down malt sales, prices differ from region to region

...Click here

Europe: Lower barley prices slow down malt sales, prices differ from region to region

...Click here

|

France: Malting barley market blocked, feed barley a little better than last week

...Click here

France: Malting barley market blocked, feed barley a little better than last week

...Click here

|

Europe: Barley growers in EU continue to shift to other cereals

...Click here

Europe: Barley growers in EU continue to shift to other cereals

...Click here

|

UK: New cereals partnership targets Scottish malting barley industry

...Click here

UK: New cereals partnership targets Scottish malting barley industry

...Click here

|

Czech Republic: The Japanese breweries are still the most important customers for Czech hops, the critical situation on the hop market lead to the increase in hop imports

...Click here

Czech Republic: The Japanese breweries are still the most important customers for Czech hops, the critical situation on the hop market lead to the increase in hop imports

...Click here

|

UK: Diageo Q3 sales up 7%, keeps profit forecast

...More Info

UK: Diageo Q3 sales up 7%, keeps profit forecast

...More Info

|

Australia: Big rise in beer tax will harm sector

...More Info

Australia: Big rise in beer tax will harm sector

...More Info

|

India: SABMiller launches Indian beer to take on Kingfisher

...More Info

India: SABMiller launches Indian beer to take on Kingfisher

...More Info

|

Nigeria: Nigerian Brewery to build two new beer plants

...More Info

Nigeria: Nigerian Brewery to build two new beer plants

...More Info

|

India: Global buys pushed United Breweries to drag Heineken to court

...More Info

India: Global buys pushed United Breweries to drag Heineken to court

...More Info

|

UK: Heineken is undertaking field trials of oversize glassware within pubco outlets to calm concerns

...More Info

UK: Heineken is undertaking field trials of oversize glassware within pubco outlets to calm concerns

...More Info

|

China: Asia Pacific Breweries appoints new regional director for China

...More Info

China: Asia Pacific Breweries appoints new regional director for China

...More Info

|

USA: Miller to be the official beer of Westgate City Center

...More Info

USA: Miller to be the official beer of Westgate City Center

...More Info

|

Australia: Tasmanian barley plantings cut by 40%

...More Info

Australia: Tasmanian barley plantings cut by 40%

...More Info

|

India: Barley may open down on government curbs

...More Info

India: Barley may open down on government curbs

...More Info

|

Belgium: InBev Q1 disappoints but fundamentals remain unchanged

Belgium: InBev Q1 disappoints but fundamentals remain unchanged

|

InBev, announced its results for the first quarter of 2008 (1Q08), in a press release, May 8.

• Total volumes: total volumes declined by 0.4% in the quarter, while our own beer volumes were 0.7% below last year, driven primarily by weak industry performance in Brazil.

• Revenue growth: total revenue grew by a solid 4.8% during 1Q08, while revenue per Hl grew 5.2%

• Cost of Sales: consolidated cost of sales (CoS) per Hl grew by 9.9% in 1Q08, reflecting the impact of higher input costs year-on-year (yoy) versus a very low base in 1Q07.

• Continued expense control: operating expenses rose modestly, as a result of anticipated sales and marketing expenses; while administrative expenses declined by 2.5%.

• EBITDA: despite revenue growth of 4.8% and further administrative expense reduction, normalized EBITDA was essentially flat for the quarter (+0.7%), as a result of a strong increase in cost of sales and phasing in commercial expenses. EBITDA margin ended the quarter at 30.7%, an organic decline of 124 basis points.

• Earning Per Share: Normalized EPS was 0.44 versus 0.46 during the same quarter of last year.

• Returning cash to shareholders: InBev returned a total of 518 million euro during the 1Q08, as a result of acquiring 322 million euro of InBev shares

...More Info

|

India: SABMiller to invest $500 million in India in five years to increase production capacity

India: SABMiller to invest $500 million in India in five years to increase production capacity

|

UK-based beer manufacturer SABMiller plans to more than double its capacity in India in the next five years with an investment of around Rs 2,000 crore (approx 500 million dollars), The Economic Times published May 7.

"We will spend around 500 million dollars to modernise our existing facilities and increase our production capacity to more than double in the country in the next five years," SABMiller India Director, Corporate Affairs and Communication, Sundeep Kumar told PTI.

The company, which market and produce beer brands such as Foster, Royal Challenge and Haywards in the country, is gearing up its capacity to meet the growing demand of beer in India, he said.

SABMiller has 10 facilities in India with production capacity of around 50 million cases per annum, which is expected to be around 105 million cases pa by the end of 2013, he said.

The company is targeting a growth of around 15 per cent per annum for the next five years, he said, adding that it, however, has no plans to set up any greenfield manufacturing unit in the country.

SABMiller has around 36 per cent share in the domestic beer market and is the second largest beer maker in the country.

The beer manufacturer has

...More Info

|

Europe: Beer sales started poorly in the EU

Europe: Beer sales started poorly in the EU

|

Beer sales have started poorly in the EU, weather did not help the brewing industry, analysts have recetly reported.

In Russia leading brewers warned that the time of double-digit increases of beer sales is over, but the industry remains on an expansion course. The same is true for China, however, the Olympic Games should push sales this summer. It is a pity that beer quality is low, with the lowest malt use per unit of beer in the world. We wonder whether China can continue to replace malt by large amounts of adjuncts, because maize and especially rice have become much more expensive as well.

Latin America and even North America, Southeast Asia and Africa are expected to do well again this year, as seen by first quarter reports of brewing companies.

|

Ukraine: SABMiller to buy Ukrainian brewer CJSC Sarmat

Ukraine: SABMiller to buy Ukrainian brewer CJSC Sarmat

|

SABMiller Plc. said it will acquire CJSC Sarmat, one of Ukraine's largest brewers, Thomson Financial reported May 8.

The company did not disclose the purchase price but said Sarmat's gross assets were worth around $130 million.

SABMiller Europe managing director Alan Clark said the deal marked the company's entry into the fast-growing Ukraine market, which grew roughly 14 percent in the four years to 2006.

|

Denmark: Carlsberg to grow Kronenbourg beer’s profitability

Denmark: Carlsberg to grow Kronenbourg beer’s profitability

|

Carlsberg, the new owner of Scottish & Newcastle's Brasseries Kronenbourg last week said that, as part of its new governance structure, the French company is to report directly to CEO Jørgen Buhl Rasmussen during its integration process, according to FlexNews, May 5.

Buhl Rasmussen sees the integration of the Alsace brewer as a challenge. Talking to the French financial press, he said that he wants to grow Kronenbourg’s profitability by 40% in the next 3 years.

He believes that the French company can increase its sales by focussing on high-quality beers, which have been less impacted by consumption drops than regular beers (a 3% drop over the last 20 years), as well as by growing its market share in bars and restaurants, which currently stands at 34%, he told reporters.

Meanwhile, he added that extra efforts will be made to establish Kronenbourg better in the foreign markets. Buhl Rasmussen sees northern Europe and Eastern Europe as possible destinations for the French beer.

The financial press mentioned that the Carlsberg CEO did not disclose any information concerning a possible restructuring of the Kronenbourg, which employs approximately 1,500 people. However, he did not rule out the transfer of some of Kronenbourg’s activities, such as the accountancy

...More Info

|

UK: Diageo silent on Guinness brewery closure

UK: Diageo silent on Guinness brewery closure

|

A report that Diageo is to close part of its historic Guinness brewery in Dublin is “pure speculation”, the group says, according to Drinks International, May 6.

Diageo is poised to announce it will sell a significant part of the St James’s Gate brewery site, a report in the Times newspaper said this weekend.

A Diageo spokesperson confirmed to Drinks International that the firm is nearing the end of a 12-month review of its brewing operations in Ireland, but she dismissed rumours about the Guinness site as “pure speculation”.

Guinness has been brewed at St James’s Gate since 1759.

Whatever the outcome of the review, it is thought unlikely Diageo would abandon the site completely. Tourists still flock to see the place where Guinness was born. And the black stuff’s all-important ingredient, known as the ‘essence of Guinness’, can only be sourced from St James’s Gate and the Waterford brewery.

Diageo currently operates four breweries in Ireland.

|

Europe: Lower barley prices slow down malt sales, prices differ from region to region

Europe: Lower barley prices slow down malt sales, prices differ from region to region

|

Lower prices in barley markets provoked a further slow-down of malt sales, as is usual in declining markets, analysts have recently reported.

Interesting: malt markets do not reflect the full extent of the down trend of barley markets. Reasons are: 1) maltsters cannot buy large quantities of new crop barley, farmers and first hand are hardly in the market, and the second hand market is very thin; 2) maltsters are already well sold for the calendar year 2009, they are in the comfortable position to pick their customers and business carefully; 3) maltsters have to cope with the constant rise of energy prices. The present market shows an advantage of long-term agreements. Within existing LTA’s barley prices can be fixed fairly easily on basis of known market quotes, while all the above mentioned factors come into play for regular malt business.

It is difficult to name realistic market prices at present, they differ from seller to seller and they differ from region to region. Domestic prices for malt of crop 2008 inside the EU are ranging from EUR 520,- to 540,-, export prices FOB in bulk in container are at similar levels. Prices for 2008 delivery are higher, provided one finds

...More Info

|

France: Malting barley market blocked, feed barley a little better than last week

France: Malting barley market blocked, feed barley a little better than last week

|

The malting barley market is still little developed in new crop while in old crop the transactions are absent, La Depeche published May 8. The quotations are almost unchanged from a week to another with operators assured by the good weather in French main producing regions. On the other hand, the weather conditions are worrying in the North of the EU where there is a need of some rain.

Feed barley quotations are higher than last week following the prices for wheat.

|

Europe: Barley growers in EU continue to shift to other cereals

Europe: Barley growers in EU continue to shift to other cereals

|

Most farmers in the EU, particularly the Germans, continue their withholding policies, analysts reported May 2.

And premiums are too low to keep farmers away from shifting larger acreage to wheat and oilseeds in 2009. An abundant supply of malting barley this year could turn into renewed tightness in 2009. EU barley prices, feed and malting, will also be influenced strongly by world markets.

High price levels have eliminated restitutions (export subsidies) and minimized the risk of import taxes, the doors to and from world markets are fully open. EU barley exports, mainly feed barley, were 3.6 Mill. tons from July 2007 till end April of this year. For domestic consumption the EU imported almost no barley, but 12.1 Mill. tons of maize and 4,3 Mill. tons of sorghum.

|

UK: New cereals partnership targets Scottish malting barley industry

UK: New cereals partnership targets Scottish malting barley industry

|

Arable farmers in Angus, Tayside, are set to invest £13-14 million in a new 90,000 tonne capacity advanced grain processing plant at Glenesk, Montrose, to cash in on Scotland’s expanding market for malting barley, FWi

Reported May 7.

Farmers claim it will be the first fully integrated supply chain operation of its kind in the UK and will be unique in having a direct conveyor link to Greencore’s adjoining maltings (pictured).

Savings in transport costs alone from moving grain direct from farm to the new store – rather than to a third-party store – are estimated at £15-20/tonne plus the value which will be added by delivering a more consistent product processed in a modern, central plant and on-tap availability to the maltings.

“The investment in this state-of-the-art facility will be worth it just for the benefit of getting grain moved quickly at harvest time without the risk of rejection on arrival at the maltings,” said David Fairlie, Kikrton, Monikie, Dundee, who is one of eight Angus farmers behind the project, which is to be known as the Angus Cereal Partnership.

Storage

The first phase of the development for half the eventual projected storage capacity – 45,000 tonnes – is due for completion in time for

...More Info

|

Czech Republic: The Japanese breweries are still the most important customers for Czech hops, the critical situation on the hop market lead to the increase in hop imports

Czech Republic: The Japanese breweries are still the most important customers for Czech hops, the critical situation on the hop market lead to the increase in hop imports

|

The Japanese breweries are still the most important customers for Czech hops, the critical situation on the hop market lead to the increase in hop imports, Hop-growers Union of the Czech Republic has recently reported.

With regards to the below average results of hop crops 2006 and 2007 in the Czech Republic there was also a reduction in the amount of exported hops. In the case of hop pellets there was a 15 % reduction compare to year 2006. In the past period there was a decrease mainly in the export of cone hops, the quantity of exported hop pellets remained in the last 14 years stable at around 3300 t of hop pellets (which is around 4200 t of dry cone hops).

The main part of hop pellets was again exported to Japan, altogether 1750 t. The Japanese breweries Asahi, Kirin, Sapporo and Suntory are the largest customers for Czech hops and take around 40 % of the Czech hop crop (variety Saaz).

TOP 10 destinations of hops from the Czech Republic in 2007:

1. Japan

2. Germany

3. Poland

4. China

5. Russia

6. Great Britain

7. South Africa

8. Belgium

9. Vietnam

10. India

„In the last ten years hops and hop products from the Czech Republic were directly exported to over 73 countries of

...More Info

|

Fungal Contamination and the Levels of Mycotoxins (DON and OTA) in Cereal Samples from Poland and East Slovakia

Fungal Contamination and the Levels of Mycotoxins (DON and OTA) in Cereal Samples from Poland and East Slovakia

EVA ČONKOVÁ1, ANNA LACIAKOVÁ1, IGOR ŠTYRIAK (2), LUDWIK CZERWIECKI (3)

and GRAŻYNA WILCZYŃSKA (3)

1) Institute of Pharmacy and Pharmacology, University of Veterinary Medicine in Košice, Košice, Slovak Republic;

2)Institute of Animal Physiology, Slovak Academy of Sciences, Košice, Slovak Republic;

3) Institute of Agricultural and Food Biotechnology, Warsaw, Poland

Abstract

ČONKOVÁ E., LACIAKOVÁ A., ŠTYRIAK I., CZERWIECKI L., WILCZINSKA G. (2006): Fungal contamination

and the levels of mycotoxins (DON and OTA) in cereal samples from Poland and East Slovakia. Czech

J. Food Sci., 24: 33–40.

The cereal samples were taken immediately after harvest from the selected localities of Poland (45 samples) and East

Slovakia (60 samples). Fungal contamination of these samples was investigated and subsequently the presence of two

important mycotoxins, deoxynivalenol (DON) and ochratoxin A (OTA), was quantitatively examined. Concerning

mould contamination, no difference was observed between the samples from Poland and East Slovakia. The highest

incidence was observed of Fusarium, Aspergillus, and Penicillium genera. However, most of the investigated samples

of wheat, rye, and barley contained less than 104 cfu/g. The limit 750 ppb for DON in cereals and their products, recommended

by the European Mycotoxin Awareness Network (EMAN), was exceeded only by one wheat sample (4.5%)

from Poland, but by seven wheat samples (14.6%) from Slovakia. None cereal sample investigated for OTA exceeded

the allowed limit – 5 µg/kg.

Keywords: wheat; rye; barley; microscopic fungi; ochratoxin A (OTA); deoxynivalenol (DON)

...

Load full article, 8 pages, 206 Kb, PDF file

|

French Malting Barley Prices. Nominal prices

| EURO = USD 1.5464 May 08, 2008 |

| Crop year |

2007 |

2008 |

| Parity |

FOB Creil |

FOB Creil |

| Position |

July 2007 |

July 2008 |

| Type |

Variety |

EURO |

USD |

EURO |

USD |

| 2RS |

Scarlett |

nq |

nq |

244.00 |

377.50 |

| 2RS |

Prestige |

nq |

nq |

243.00 |

376.00 |

| 2RS |

Cellar |

nq |

nq |

242.00 |

374.50 |

| 2RS |

Sebastien |

nq |

nq |

241.00 |

373.00 |

| 2RS |

Astoria |

nq |

nq |

241.00 |

373.00 |

| 2RS |

Cork |

nq |

nq |

241.00 |

373.00 |

| 6RW |

Esterel |

nq |

nq |

222.00 |

343.50 |

French Feed Barley Prices. Nominal prices

| EURO = USD 1.5464 May 08, 2008 |

| Crop year |

2007 |

| Parity |

FOB Creil |

| Position |

July 2007 |

| Type |

EURO |

USD |

| Feed Barley |

163.00 |

252.00 |

Prices for Danish malting barley are available

on site

www.e-malt.com/MarketPrices

| EURO = USD 1.5464 May 08, 2008 |

| Crop year |

2007 |

| Parity |

FOB Antwerp |

| Position |

May 2008 - Sep 2008 |

| Conditioning |

Bulk |

In bags |

Bulk containers |

Bags, containers |

| Malting barley variety |

EURO |

USD |

EURO |

USD |

EURO |

USD |

EURO |

USD |

| 2RS |

Scarlett |

525.50 |

812.50 |

549.50 |

849.50 |

541.00 |

836.50 |

555.50 |

858.50 |

| 2RS |

Prestige |

524.50 |

811.00 |

548.00 |

847.50 |

540.00 |

835.00 |

554.00 |

856.50 |

| 2RS |

Cellar |

523.00 |

809.00 |

547.00 |

845.50 |

538.50 |

833.00 |

553.00 |

855.00 |

| 2RS |

Sebastien |

522.00 |

807.00 |

545.50 |

843.50 |

537.50 |

831.00 |

551.50 |

853.00 |

| 2RS |

Astoria |

522.00 |

807.00 |

545.50 |

843.50 |

537.50 |

831.00 |

551.50 |

853.00 |

| 2RS |

Cork |

522.00 |

807.00 |

545.50 |

843.50 |

537.50 |

831.00 |

551.50 |

853.00 |

| 2RS |

Average price |

523.00 |

809.00 |

547.00 |

845.50 |

538.50 |

833.00 |

553.00 |

855.00 |

| 6RW |

Esterel |

490.00 |

759.50 |

515.00 |

796.00 |

506.50 |

783.50 |

521.00 |

805.50 |

| * |

Asia Malt 70/30 |

513.50 |

794.00 |

537.50 |

830.50 |

529.00 |

818.00 |

543.50 |

840.00 |

| ** |

Asia Malt 50/50 |

507.00 |

784.00 |

531.00 |

820.50 |

522.50 |

808.50 |

537.00 |

830.00 |

| EURO = USD 1.5464 May 08, 2008 |

| Crop year |

2008 |

| Parity |

FOB Antwerp |

| Position |

Oct 2008 - Sept 2009 |

| Conditioning |

Bulk |

In bags |

Bulk containers |

Bags, containers |

| Malting barley variety |

EURO |

USD |

EURO |

USD |

EURO |

USD |

EURO |

USD |

| 2RS |

Scarlett |

486.50 |

752.50 |

510.50 |

789.00 |

502.50 |

776.50 |

516.50 |

798.50 |

| 2RS |

Prestige |

485.50 |

750.50 |

509.00 |

787.50 |

501.00 |

774.50 |

515.50 |

796.50 |

| 2RS |

Cellar |

484.50 |

748.50 |

508.00 |

785.50 |

500.00 |

773.00 |

514.00 |

794.50 |

| 2RS |

Sebastien |

483.00 |

747.00 |

506.50 |

783.50 |

498.50 |

771.00 |

512.50 |

793.00 |

| 2RS |

Astoria |

483.00 |

747.00 |

506.50 |

783.50 |

498.50 |

771.00 |

512.50 |

793.00 |

| 2RS |

Cork |

483.00 |

747.00 |

506.50 |

783.50 |

498.50 |

771.00 |

512.50 |

793.00 |

| 2RS |

Average price |

484.50 |

748.50 |

508.00 |

785.50 |

500.00 |

773.00 |

514.00 |

794.50 |

| 6RW |

Esterel |

458.50 |

710.50 |

483.50 |

747.50 |

475.50 |

734.50 |

489.50 |

756.50 |

| * |

Asia Malt 70/30 |

477.00 |

737.50 |

500.50 |

774.00 |

492.50 |

761.50 |

506.50 |

783.50 |

| ** |

Asia Malt 50/50 |

472.00 |

729.50 |

495.50 |

766.50 |

487.50 |

753.50 |

501.50 |

775.50 |

NB: Prices published are theoretical malt prices including financial cost,

THC (for bulk and bags container) and all administrative costs.

This prices may fluctuate according to the quantity per delivery

and technical specifications.

* - 70/30 = 70% Average two Rows Spring and 30% Six Rows Winter

** - 50/50 = 50% Average two Rows Spring and 50% Six Rows Winter

Source: E-malt.com

China Barley Supply and Disposition 2002-2009f

| mln tonnes |

2002-2003 |

2003-2004 |

2004-2005 |

2005-2006 |

2006-2007 |

2007-2008 |

2008-2009f |

| Carry-in Stocks |

0.5 |

0.7 |

0.3 |

0.2 |

0.3 |

0.2 |

0.2 |

| Production |

3.3 |

2.7 |

3.2 |

3.4 |

3.6 |

3.6 |

3.8 |

| Imports |

1.8 |

1.5 |

2.0 |

2.2 |

1.1 |

1.2 |

1.3 |

| Total Supply |

5.6 |

5.0 |

5.5 |

5.8 |

5.0 |

5.0 |

5.2 |

| Exports |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

| Feed Use |

1.4 |

1.0 |

1.5 |

1.4 |

1.0 |

0.9 |

1.0 |

| Food Use |

3.5 |

3.7 |

3.9 |

4.2 |

3.8 |

3.8 |

3.9 |

| Total Use |

4.9 |

4.7 |

5.4 |

5.6 |

4.8 |

4.8 |

5.0 |

| Carry-out Stocks |

0.7 |

0.3 |

0.2 |

0.3 |

0.2 |

0.2 |

0.2 |

Source: USDA (FAS); f-Forecast, AAFC April 25, 2008; Numbers may not add due to rounding.

| |

Copyright © E-Malt s.a. 2008

|